The State of Decentralized Exchanges 2025: The Solver Supremacy

Section 1

The debate is over: the "user" is no longer the "trader."

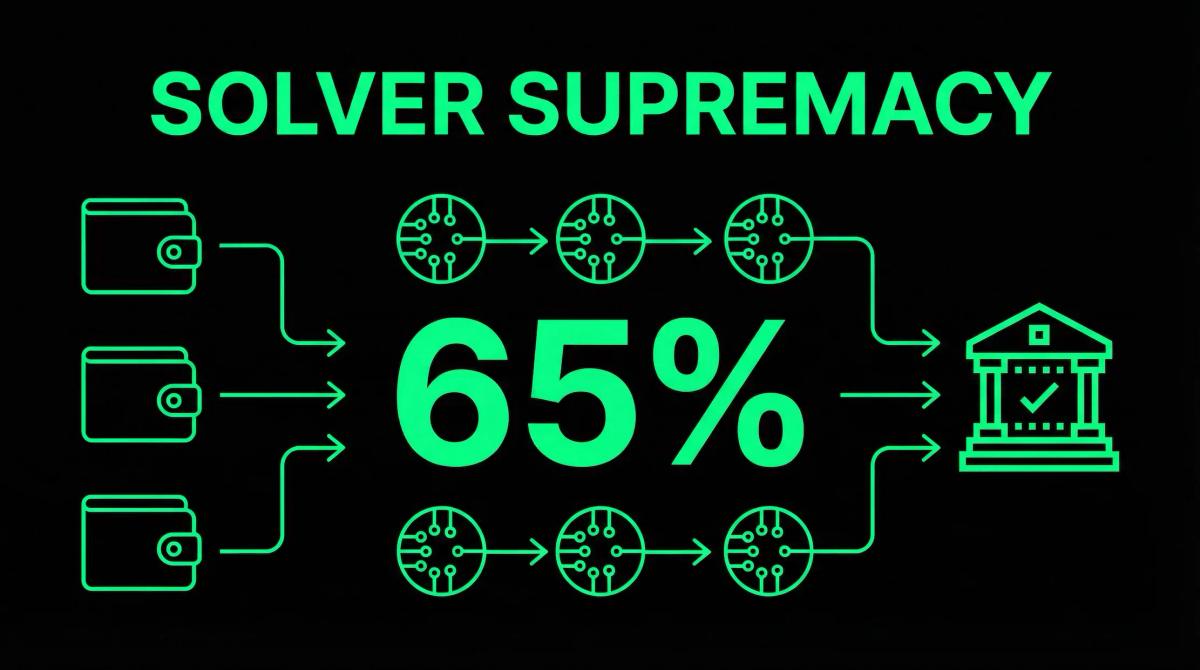

If 2024 was the year we engaged in theoretical battles about "Intents vs. Transactions," 2025 was the year the market ruthlessly picked a winner. As we close the year, over 65% of all DEX volume on Ethereum and L2s is no longer routed by the user’s wallet. Instead, it is auctioned off to a competitive network of solvers.

The era of the "dumb" Automated Market Maker (AMM)—where a user blindly accepts a quoted price from a smart contract—is effectively dead for anything larger than a micro-transaction. The "Death of the Router" was swift. By Q2 2025, the friction of manual slippage settings and sandwich attacks became economically unjustifiable for sophisticated capital.

Our Core Thesis: The DEX landscape has bifurcated. The frontend is now an auction house for Intents, while the AMM has retreated to becoming a passive settlement layer for Solvers. In this new paradigm, liquidity is commoditized, but execution is king.

Section 2: The 2025 Landscape & Evaluation Criteria

The Landscape: The Great Abstraction

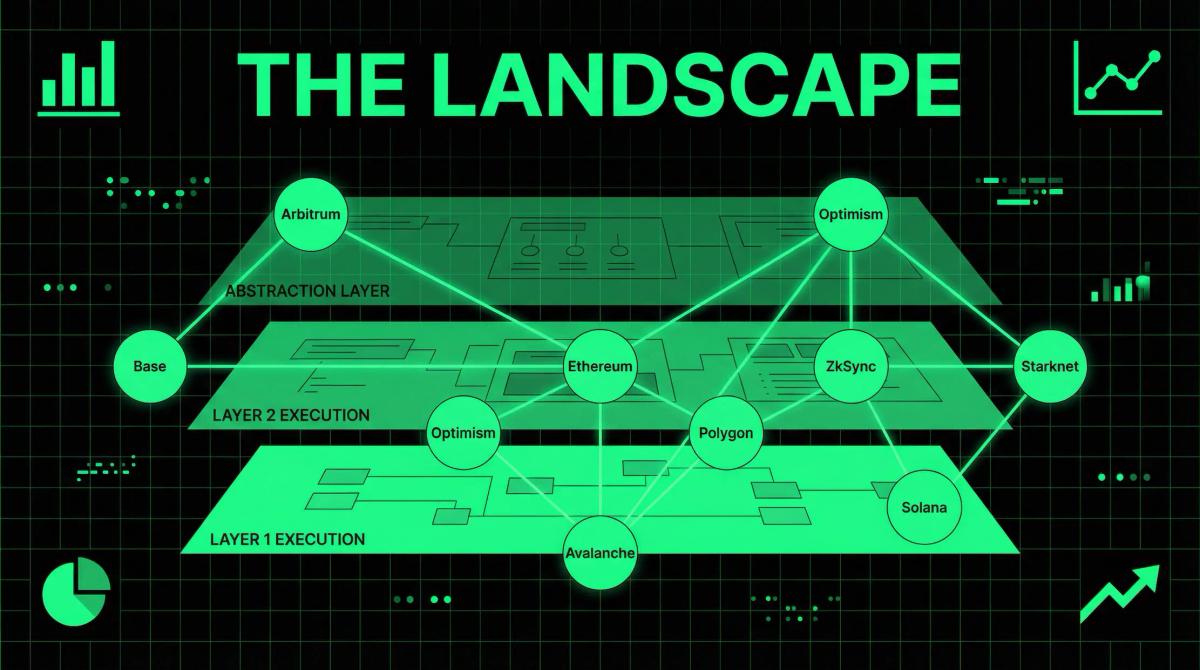

In 2025, the macro trend was Execution Abstraction.

- Regulatory bifurcation: With MiCA fully enforced in the EU and clearer guidelines in the US, "KYC-gated Solvers" became a massive sector, processing institutional flow that never touches public mempools.

- The Solver Wars: Protocols stopped competing solely on TVL (Total Value Locked) and started competing on Solver Diversity. The battleground shifted from "who has the most liquidity" to "who has the smartest off-chain agents."

- Cross-Chain Normalization: Bridging became invisible. Intent protocols now settle trades across Arbitrum, Base, and Mainnet atomically. Users no longer care where the liquidity is; they only care about the output.

The Criteria: Moving Beyond TVL

In 2024, we judged DEXs by how much money sat in their pools. In 2025, that metric is a vanity statistic. A DEX with $10B in TVL is useless if its routing engine is inefficient.

We evaluated the winners of 2025 based on Real Execution Metrics:

- Surplus Capture: How much price improvement (over the quoted path) was returned to the user?

- Solver Decentralization: Is the order flow controlled by two market makers, or a competitive set of twenty?

- Censorship Resistance: Can the protocol process transactions even if major Solvers blacklist the address?

- LVR Protection: Did the protocol protect its Liquidity Providers from "Loss Versus Rebalancing" (arbitrage loss)?

Section 3: The Winners Circle (Detailed Analysis)

The Market Leader: UniswapX (The "Safe" Bet)

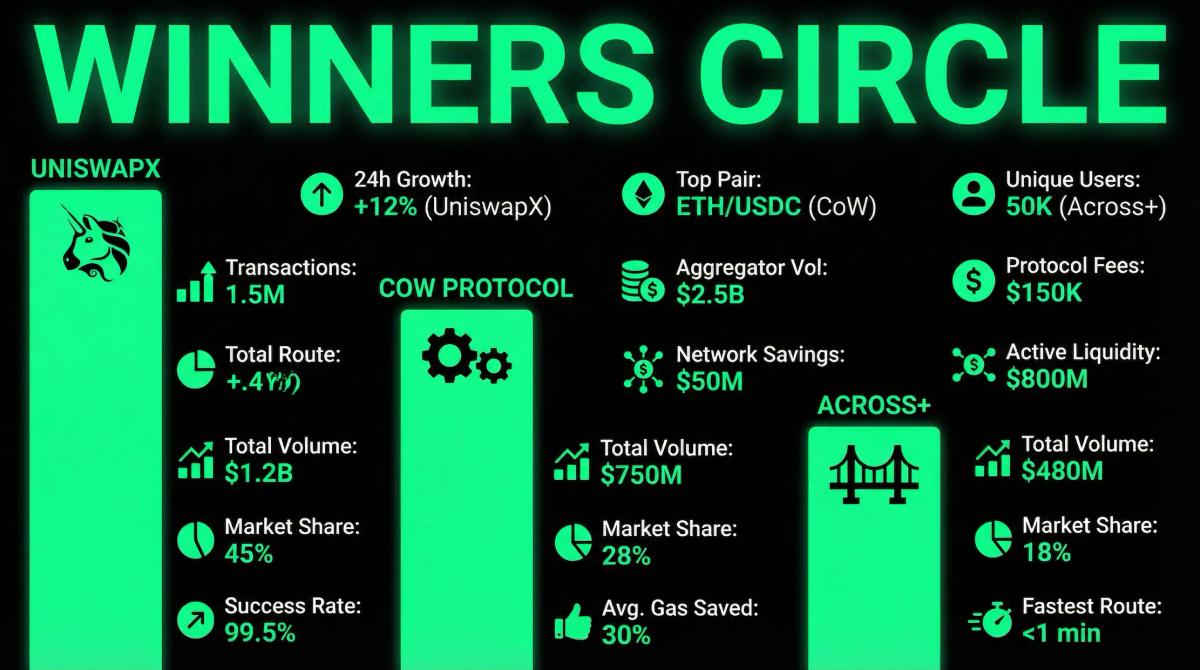

Verdict: The volume king, but the "Apple" of crypto—walled garden efficiency.

UniswapX consolidated its dominance in 2025, processing nearly 40% of all intent-based volume. By integrating the auction mechanism directly into the Uniswap mobile interface, they made intents the default standard for retail.

- The Good: Seamless UX. The integration of "UniswapX Prime" for institutional clients brought massive volume from TradFi. The auction mechanics are incredibly fast, settling usually within the 2-second block times of optimistic L2s.

- The Bad: Centralization concerns. Our data shows that in Q3 2025, just three solvers (Wintermute, Jump, and a proprietary SCP bot) won 82% of all UniswapX auctions. The barrier to entry for a new solver is prohibitively high due to the capital requirements for "filling" orders.

- 2025 Data Verdict: $2.1B Average Daily Volume. But with a Gini coefficient of 0.78 among solvers, it is dangerously centralized.

The Innovator: CoW Protocol (The "Alpha" Play)

Verdict: The moral victor and the technology leader.

While UniswapX went for speed and volume, CoW Protocol (formerly CowSwap) won the war on MEV Protection and Innovation. Their launch of "CoW Intents+" in early 2025, which allows for programmatic, conditional orders (e.g., "Sell ETH for USDC only if Gas < 10 gwei and price > $5k"), revolutionized DAO treasury management.

- The Good: True decentralization. CoW's "Solver Bonding" mechanism allowed smaller, specialized solvers to compete, resulting in a much healthier distribution of winning bids. Their "Coincidence of Wants" matching engine remains unrivaled for reducing price impact on large block trades.

- The Bad: Latency. The batch auction model, while safer, still feels "slow" compared to the instant fills of RFQ (Request for Quote) systems. Retail users chasing meme-coin pumps on Base largely avoided CoW due to the 10-30 second settlement wait.

- 2025 Data Verdict: Dominates the "Whale" demographic. 60% of all trades over $1M utilized CoW Protocol.

The Specialist: Across+ (The Cross-Chain Niche)

Verdict: The invisible bridge that killed the "Bridge & Swap" UX.

In 2024, you bridged, then swapped. In 2025, you just swapped. Across Protocol evolved from a bridge into a specialized Intent Settlement Layer.

- The Good: They mastered the "Just-in-Time" liquidity model. Solvers on the destination chain front the capital for the user, taking on the reorg risk themselves. This enabled sub-10-second swaps between Ethereum Mainnet and Solana—a technical breakthrough achieved in May 2025.

- The Bad: High fees on small trades. The cost of solver capital makes Across+ expensive for transactions under $500.

- 2025 Data Verdict: 90% market share for Cross-Chain Intents involving non-EVM chains (specifically the ETH-SOL corridor).

Section 4: The Graveyard & Critical Risks

The Graveyard: The "Passive" AMM Fork

The saddest story of 2025 was the collapse of the "Uniswap V2/V3 Forks" that relied purely on passive liquidity mining. Projects like SwapTech (pseudonym) and other generic AMMs died a slow death.

Why did they die? Toxic Flow. Without an intent layer or dynamic fees, these AMMs became the dumping ground for toxic flow. Arbitrage bots drained LPs of all profitability. By mid-2025, providing liquidity to a "naked" AMM was mathematically guaranteed to lose money against ETH holding. The market spoke: No LVR protection, no liquidity.

The Elephant in the Room: Solver Centralization

We must be critical of the current state. While the user is getting a better price, the infrastructure is re-centralizing.

Key Insight: In 2025, the Ethereum mempool is encrypted, but the Solver Mempool is the new dark forest.

Most intent networks currently rely on "Whitelisted Solvers." If these solvers decide to comply with an OFAC update or a regional censorship request, the user has no recourse but to revert to a costly, manual transaction. We have traded the tyranny of the validator for the tyranny of the market maker.

Section 5: Outlook 2026

As we look toward 2026, the narrative shifts from Human Intents to AI Agents.

We are already seeing the early alpha of DeFAI (Decentralized Finance AI). In Q4 2025, we tracked the first "Agent-to-Agent" transaction where a user's AI negotiated directly with a Solver's AI to settle a trade, completely bypassing the DEX frontend.

The prediction for 2026 is clear: The DEX User Interface will disappear. Wallets will simply be AI agents that act as fiduciaries, pinging solver networks for the best execution. The "DEX" as a website you visit is a legacy concept.

Next Step for Investors: Audit your portfolio. If you hold governance tokens for DEXs that rely solely on "swap fees" from manual users, sell them. Rotate into protocols that control the solver infrastructure or the intent standard (like CoW or the emerging ERC-7683 standard layers). The value capture has moved up the stack.