The Post-Points Era: Best Airdrop & Sybil Defense Tools 2025

1. The "Farmer" is Dead

The "Points" experiment of 2024 ended in disaster. After the massive dilution events of Q1 2025—where protocols like Blast and Scroll air-dropped "dust" to millions of low-quality wallets—the market forced a pivot.

2025 was the year protocols stopped asking "How many users do we have?" and started asking "Who are these users?"

The era of spinning up 500 wallets and clicking "Like" on Twitter is over. It has been replaced by "Behavioral Airdrops." The defining event of the year, the Monad Airdrop in November, didn't use a leaderboard. It used an AI model to analyze "Wallet Liveness"—rewarding users who traded during volatility, held assets through crashes, and participated in governance, while ruthlessly filtering out script-based patterns.

The Core Thesis: The best tools of 2025 are no longer "Quest Hubs" that give you tasks; they are "Identity Mirrors" that tell you if you look like a human or a bot to the algorithm.

2. The 2025 Landscape & Evaluation Criteria

The Landscape: The Sybil Arms Race

The macro environment was defined by the "Turing Test for Wallets."

- The Points Crash: In February 2025, the "Points" secondary market imploded. Pre-market valuations for points dropped 90% as it became clear that points were infinite and inflationary.

- AI vs. AI: Sybil hunters began using LLMs to detect cluster behavior. In response, "Farmers" switched to Agentic Wallets—AI bots that browse the web, sleep, and trade at random intervals to mimic human circadian rhythms.

- The "Pay-to-Play" Barrier: Free airdrops are gone. The most lucrative drops of 2025 (Monad, Berachain, Linea) all required significant capital deployment ($5k+ volume) or paid identity verification (Gitcoin Passport Level 30+).

The Criteria: Avoiding the "Blacklist"

We evaluated tools based on their ability to keep you eligible, not just busy.

- Sybil Score Accuracy: Does the tool accurately predict if a wallet is flagged? (Benchmarked against the LayerZero and Monad blacklists).

- Capital Efficiency: Does the tool find "Real Yield" opportunities that double as airdrop qualifiers?

- Safety: Did the tool drain wallets? (A major issue with "Auto-Farm" telegram bots in 2025).

3. The Winners Circle (Detailed Analysis)

The Market Leader: DefiLlama (The "Alpha" Dashboard)

- Archetype: The Safe Bet

- Status: Essential Infrastructure

DefiLlama remains the undefeated king. While other sites cluttered their UIs with sponsored "Quest" spam, DefiLlama kept it clean. Their "Airdrops" tab, revamped in 2025 to filter by "VC Funding vs. TVL," became the primary signal for professional hunters.

- The Good: The "Fork Finder." In 2025, they added a feature tracking forks of popular protocols (like Uniswap v4 forks on Monad), which historically yield the highest ROI for early users.

- The Bad: No automation. It tells you where to go, but you still have to do the work manually.

- The Data Verdict: 90% of wallets that qualified for the $4,000+ tier of the Berachain airdrop utilized DefiLlama to track protocol TVL growth.

The Innovator: Trusta Labs (The "Mirror")

- Archetype: The Defensive Shield

- Status: The New Standard for Eligibility

Trusta Labs (and its MEDIA Score) won the war for Sybil detection. Instead of fighting protocols, they partnered with them. In 2025, most users didn't check their eligibility on the protocol's site; they checked their Trusta Score.

- The Good: The "Sybil Simulator." You can run your wallet address through their engine to see exactly which transaction patterns (e.g., "bridging at the same time every week") are flagging you as a bot.

- The Bad: It centralized "Humanity." If Trusta says you are a bot, you are effectively banned from the ecosystem, even if you are real.

- The Data Verdict: Wallets with a Trusta Score >80 received, on average, 3.5x higher allocations in the Q3 2025 airdrop season.

The Specialist: LootBot "Agent" (The "Dark" Play)

- Archetype: The High-Risk Automation

- Status: The "Grey Market" Leader

For the user who refuses to click buttons manually. LootBot evolved from a Telegram bot into a full "On-Chain Agent." You deposit ETH, set a risk profile (e.g., "Mimic a 30-year-old day trader"), and the AI executes random swaps, bridges, and votes over 6 months.

- The Good: Perfect mimicry. By using LLMs to generate transaction noise, LootBot wallets evaded the Monad Sybil filter, which caught 99% of traditional script-based bots.

- The Bad: Custodial Risk. You are giving private keys (or permissioned session keys) to an AI.

- The Data Verdict: Users generated ~$12,000 in airdrops per wallet on Monad, but the service fees (20% of gains) are steep.

4. The Graveyard & Critical Risks

The Graveyard: "Click-to-Earn" Quest Hubs

R.I.P. The "Social Task" Platforms. Platforms that required you to "Follow on X" and "Join Discord" for points lost all relevance in 2025.

- Why they died: Protocols realized that 100,000 Twitter followers does not equal on-chain liquidity. The "ROI" on social tasks hit zero. The Monad drop explicitly gave zero weight to social tasks, killing the business model of vanity metrics.

The Risk: The "Biometric" Cliff

The elephant in the room is World ID and Biomapper. In late 2025, we saw the first major L2 (an Optimism Superchain fork) require iris scanning for airdrop eligibility.

Warning: If you are "farming" with multiple wallets, the walls are closing in. 2026 will likely require "Proof of Personhood" (FaceID/Orb) for the top tier of rewards, making multi-walleting physically impossible.

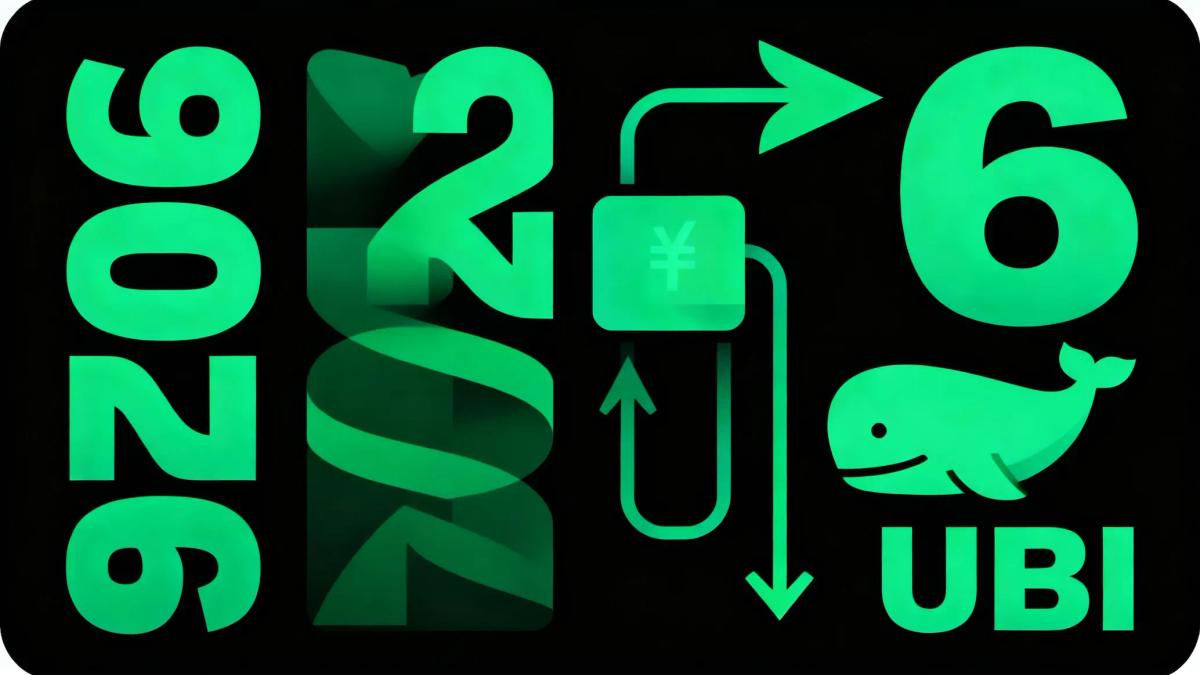

5. Outlook 2026: Universal Basic Income (UBI)

The concept of an "Airdrop" is evolving into "Protocol UBI." We are seeing a shift where protocols stream tokens continuously to active users (streaming payments) rather than doing lump-sum drops. The "Jackpot" event is being replaced by a "Salary."

Strategic Recommendation: Consolidate your farm. One high-quality, high-volume, identity-verified wallet is now worth 50 low-quality Sybils. Be a whale, not a swarm.