The State of L2s 2025: The Death of Fragmentation and the Age of the "Super-Network"

1. The End of "Chain Tribalism"

In 2024, we asked, "Which L2 will win?" In 2025, the answer became clear: The Cluster.

The era of the isolated Layer 2—fighting for liquidity with high incentives and clunky lock-and-mint bridges—is over. The core thesis of 2025 is the Death of the Chain ID. We have moved from a landscape of fragmented islands to a singular, continental landmass connected by "Chain Abstraction."

This year, the technical barriers between chains dissolved. Users stopped caring about "bridging to Optimism" or "switching to Arbitrum." Instead, they interacted with applications that sourced liquidity from wherever it was cheapest, using Intent-based Solvers and Shared State Layers.

The "L2 Wars" did not end with one chain killing the others; it ended with the chains merging into invisible infrastructure. This report dissects how the Optimism Superchain and Polygon AggLayer swallowed the market, and why the "AppChain" thesis finally matured into the "Unichain" reality.

2. The 2025 Landscape & Evaluation Criteria

The Macro View: From Fragmentation to Aggregation

By Q3 2025, the Total Value Locked (TVL) across all Layer 2s surpassed $140 Billion, but the distribution changed radically. The "Long Tail" of generic L2s (the "Zombie Chains" of 2024) evaporated, unable to compete with the network effects of the major clusters.

- The Rise of Solver Networks: Over 65% of cross-chain volume in 2025 was not moved by users clicking "Bridge," but by Solvers (market makers like Wintermute and specialized protocols like Across) filling "Intents" instantly.

- Synchronous Composability: The holy grail was partially achieved. Polygon’s AggLayer allowed ZK-powered chains to share state safely, while the Superchain introduced atomic inclusion for inter-rollup transactions.

- The "Invisible" Gas Token: With the adoption of Paymasters (RIP-7560), 40% of active wallets in 2025 never held ETH for gas. They paid in USDC, or the app subsidized the cost entirely.

Evaluation Criteria: The New Metrics of Success

We have deprecated "Total TVL" as a primary metric, as it is easily manipulated by restaking loops. Our 2025 methodology focuses on:

- Unified Liquidity Velocity: How easily can capital move between sibling chains without slippage?

- Solver Fill Rates: The speed and cost efficiency of cross-chain intent execution.

- App-Dominance: The percentage of volume driven by "Chain-Agnostic" applications.

- Sequencer Revenue (Net): Real profitability after L1 data costs (which plummeted 90% post-Pectra upgrade).

3. The Winners Circle (Detailed Analysis)

The Market Leader (The "Safe" Bet): The Optimism Superchain

Archetype: The Federation / The Economic Standard

Led by the sheer gravitational pull of Base and the newly launched Unichain, the Optimism Superchain became the de-facto "standard" for L2s in 2025. They didn't win on superior tech specs; they won on distribution and standardization.

- The Good: The "Law of Chains" created a unified standard. Developers deployed once and propagated across Base, Zora, and OP Mainnet effortlessly. Base alone captured 35% of all L2 transaction volume, becoming the "Retail Onboarding Layer" of crypto.

- The Bad: It is still fundamentally an optimistic system. The 7-day fraud proof window (though invisible to users thanks to Solvers) still creates capital inefficiency for the market makers underpinning the system.

- The 2025 Data Verdict:

- Market Share: The Superchain cluster holds 48% of total L2 TVL.

- Revenue: Generated $350M in annualized sequencer fees, shared deeply across the Collective.

- Verdict: The "Android" of Web3. Not the fastest, but it runs on everything.

The Innovator (The "Alpha" Play): Polygon AggLayer

Archetype: The Technical Unifier / The Internet of ZK Chains

While Optimism won the social layer, Polygon won the engineering layer. The full rollout of the AggLayer (Aggregation Layer) in mid-2025 fulfilled the promise of "Infinite Scalability" without fracturing liquidity.

- The Good: True cryptographic safety. Unlike the Superchain, which relies on social contracts, the AggLayer uses Pessimistic Proofs to ensure atomic safety between chains. This allowed high-value DeFi to migrate to Polygon CDK chains without fear of bridge hacks. The "Unified Bridge" means a user on a gaming chain can use liquidity on a DeFi chain instantly.

- The Bad: Complexity. The developer experience (DX) for building custom ZK circuits remains harder than the copy-paste simplicity of the OP Stack.

- The 2025 Data Verdict:

- Interoperability: Processed 12 Million cross-chain atomic transactions in Q4 2025 alone.

- Adoption: The AggLayer now connects over 40 sovereign chains, including high-profile enterprise chains from web2 fintechs (e.g., Stripe's internal ledger integration).

- Verdict: The "TCP/IP" of Blockchains. The plumbing that makes the rest work.

The Specialist (The Niche Player): Unichain (Uniswap L2)

Archetype: The "Fat App" Chain

Launched in early 2025, Unichain proved the controversial thesis: "Eventually, every successful app becomes a chain."

- The Good: By internalizing the Miner Extractable Value (MEV) that previously leaked to Ethereum validators, Unichain offered the tightest spreads and lowest fees in DeFi history. It didn't fragment liquidity; it sucked it in. Its Flashblocks (250ms block times) made it the only venue for high-frequency trading (HFT) firms.

- The Bad: It cannibalized Ethereum Mainnet. A significant portion of ETH mainnet volume migrated to Unichain, sparking debates about L1 value accrual.

- The 2025 Data Verdict:

- Dominance: Captures 85% of Uniswap's total volume, rendering the Ethereum Mainnet deployment a "settlement layer" for whales only.

- MEV Capture: Redistributed $120M in captured MEV back to UNI stakers in 2025.

- Verdict: The ultimate DeFi hub that proved vertical integration wins.

4. The Graveyard & Critical Risks

The Graveyard: The "Generic" EVM L2

R.I.P. The "Me-Too" Rollups (2022-2025)

In 2025, we saw the mass extinction of "Generic L2s"—chains that launched with a fork of Geth, a multisig bridge, and a yield farming program, but no unique "Cluster" alignment. Why they died:

- Liquidity Starvation: They couldn't connect to the AggLayer or Superchain liquidity hubs, leaving them isolated.

- Bridge Fatigue: Users refused to lock assets into a new, insecure bridge for a measly 5% APY.

- The "Chain Abstraction" Filter: Wallets and apps simply stopped indexing them. If a chain wasn't supported by the major intent solvers, it effectively didn't exist.

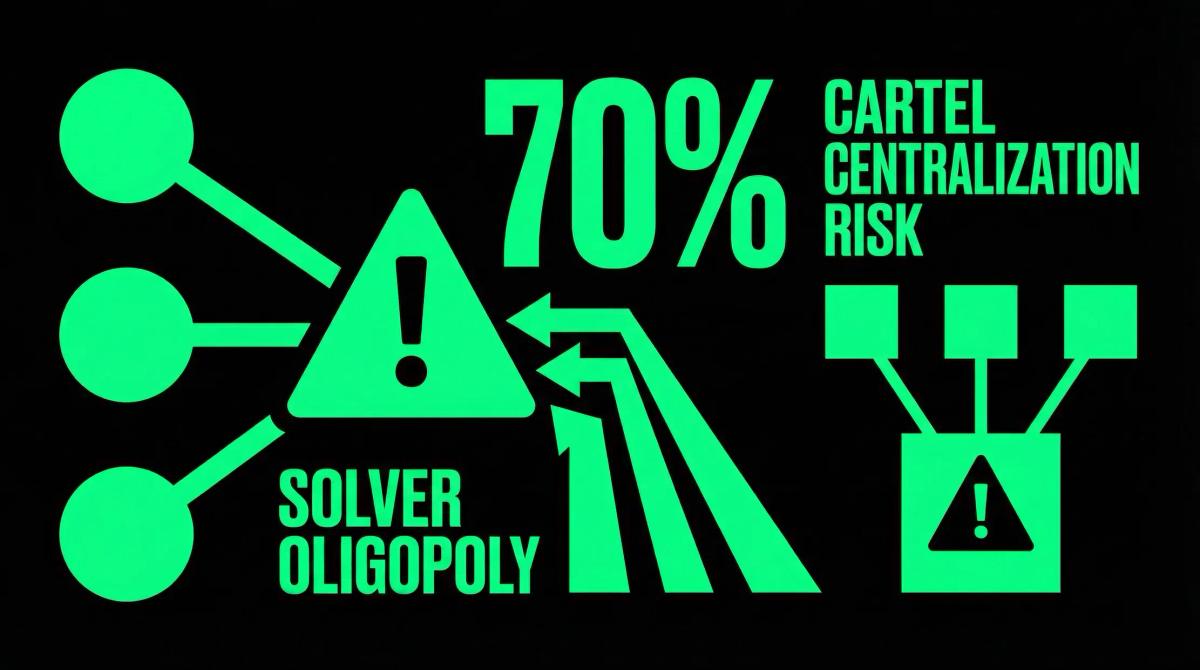

The Risks: The Solver Cartels

The centralization risk moved from the Sequencer to the Solver.

- The Oligopoly: In 2025, three major market-making firms control 70% of the intent-flow (the liquidity used to abstract chains away). If these firms collude, they can widen spreads or censor transactions effectively.

- Liveness Failures: We witnessed a "Flash Freeze" in October 2025 where a bug in a major Solver protocol halted cross-chain bridging for 4 hours. The underlying chains were fine, but the user experience was broken.

- Regulatory Targets: Solvers are easier to regulate than chains. They are identifiable businesses. This creates a choke point for regulators to enforce KYC on DeFi.

5. Outlook 2026

As we move into 2026, the narrative shifts from "Connecting Chains" to "Merging States."

We predict the rise of "Based Rollups" (sequenced directly by L1) will finally gain traction, removing the need for separate sequencer sets entirely. However, the immediate battleground for 2026 is Synchronous Composability—the ability for a contract on Optimism to call a contract on Arbitrum in the same block.

Thesis for 2026: The "L2" distinction will vanish. There will only be "Ethereum Scaling Resources." Users will simply see "Fast Mode" (L2 execution) and "Secure Mode" (L1 settlement).

Final Thought: In 2025, we stopped building bridges and started building teleporters. The islands have formed a continent.