The State of Centralized Exchanges 2025: The Regulatory Moat & The Era of the "Big Three"

The 2025 Landscape & Evaluation Criteria

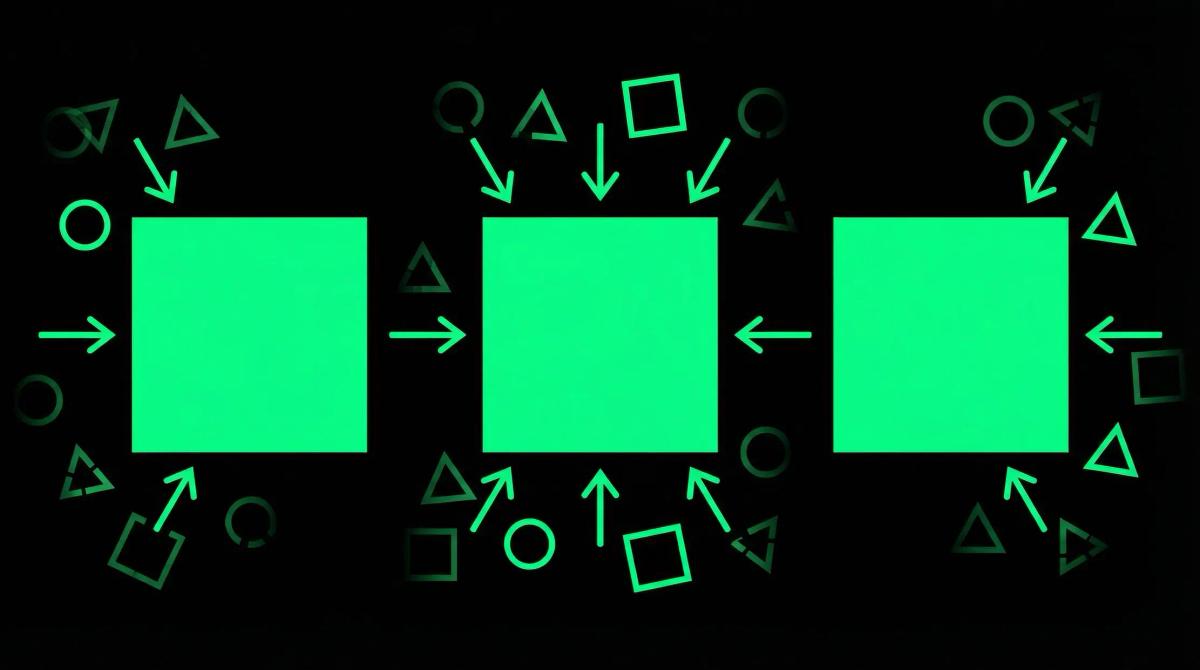

The Landscape: The Great Consolidation

The data is stark. In Q1 2024, the top 3 exchanges controlled approximately 60% of spot volume. Today, in Q4 2025, Binance, OKX, and Bybit control 88% of global retail spot and derivatives volume (excluding the isolated US-only silos like Coinbase).

Three macro trends defined 2025:

- The Compliance Tax: The operational cost to run a compliant global exchange jumped by 300% year-over-year. Between mandatory real-time surveillance, travel rule interoperability, and local office requirements, the "long tail" of exchanges simply ran out of cash.

- The Wallet War: The battleground moved off the order book. The "Exchange Wallet" (MPC-based Web3 portals) became the primary retention tool. Users now treat the CEX app not just as a trading venue, but as their browser for the decentralized web.

- Transparency as a Product: "Proof of Reserves" (PoR) evolved from a monthly marketing gimmick to a real-time, ZK-SNARK-based requirement.

The Evaluation Criteria: Survival of the fittest

We assessed the landscape not just by volume, but by Moat Durability.

- Regulatory Armor: Number of Tier-1 licenses and the ability to geo-fence users effectively without losing liquidity depth.

- Web3 Stickiness: Measured by the MAU (Monthly Active Users) of their integrated Web3 wallets and the volume bridged to their proprietary or partner L2 chains.

- Solvency Trust: The frequency, depth, and auditability of their Proof of Reserves.

The Winners Circle (Detailed Analysis)

The Market Leader: Binance (The "Sovereign State")

Archetype: The Unshakeable incumbent.

2025 Market Share: ~48% Global Volume.

Despite the "Post-CZ" skepticism of 2024, Binance did not fragment; it hardened. Under CEO Richard Teng's second year, the strategy shifted from aggressive expansion to "Diplomatic Entrenchment."

- The Good (The Compliance pivot): In 2025, Binance successfully registered its 40th global jurisdiction. Their mastery of the "Global DAO" corporate structure allowed them to satisfy local regulators (like in France and Japan) while maintaining a shared global liquidity order book—a feat of legal engineering that smaller competitors failed to replicate.

- The Tech: Their transition to a 100% ZK-MERKLE Proof of Reserves system, updated every 10 minutes, set the gold standard. Users can now cryptographically verify their specific liability inclusion in the exchange's solvency proof in near real-time.

- The Bad: Innovation stagnation. The Binance app feels bloated in 2025. While safe, it lacks the nimble, "degen-friendly" features of its rivals. They are playing defense, protecting their lead rather than pushing boundaries.

- The 2025 Data Verdict: Still the King of Liquidity. The bid-ask spreads on Binance remain 15% tighter than the nearest competitor on major pairs. Institutional capital, now comfortable with Binance's "cleaned up" image, flooded back in Q2 2025.

The Innovator: OKX (The "Super-App" Architect)

Archetype: The Tech Leader / The Gateway.

2025 Market Share: ~22% Global Volume.

If Binance is the "Bank," OKX is the "Browser." Their aggressive bet on the X Layer (their ZK-powered Layer 2) and the OKX Web3 Wallet paid off massively in 2025.

- The Good (The Wallet Strategy): OKX recognized early that the CEX is a funnel. Their Web3 wallet is now the most used non-custodial wallet in Asia, surpassing even MetaMask in mobile activity in the region. By integrating X Layer, they made on-ramping to DeFi seamless. Users don't feel like they are leaving the exchange; they feel like they are upgrading their account.

- The Alpha: They captured the "inscription" and "runes" markets of 2025 faster than anyone else, showing an ability to pivot technical resources to hot trends that Binance (bogged down by compliance bureaucracy) couldn't match.

- The Bad: Geographic concentration. Despite efforts to expand in LatAm and Europe, OKX remains heavily weighted toward Asian trading hours and flows.

- The 2025 Data Verdict: The highest "User-to-DeFi" conversion rate. 40% of OKX users engaged with their Web3 wallet features in 2025, compared to just 12% on Binance.

The Specialist: Bybit (The "Pro" Arena)

Archetype: The Derivatives Powerhouse.

2025 Market Share: ~15% Global Volume.

Bybit cemented its position as the home for sophisticated retail and semi-pro traders. They didn't try to be a bank (like Binance) or a browser (like OKX); they focused on being the best trading engine.

- The Good (Unified Trading Account 2.0): Bybit's UTA system remains the best in class for cross-margin efficiency. In 2025, they introduced "Portfolio Margin for Retail," allowing users to offset spot holdings against options risk with institutional-grade efficiency. This attracted a massive migration of "power users" who felt constrained by the simplified interfaces of competitors.

- The Good (The "Card" Integration): The Bybit Card became the surprise hit of 2025 in Europe, offering the best crypto-to-fiat conversion rates, effectively closing the loop for traders living off their profits.

- The Bad: Regulatory friction. Bybit had to exit three major jurisdictions in Q3 2025 due to an unwillingness to compromise on certain leverage limits. They have accepted they will likely remain an "offshore-lite" venue, limiting their TAM (Total Addressable Market) but deepening their niche.

- The 2025 Data Verdict: Highest Volume-Per-User. While they have fewer users than Binance, the average Bybit user trades 4x the volume of the average Binance user.

The Graveyard & Critical Risks

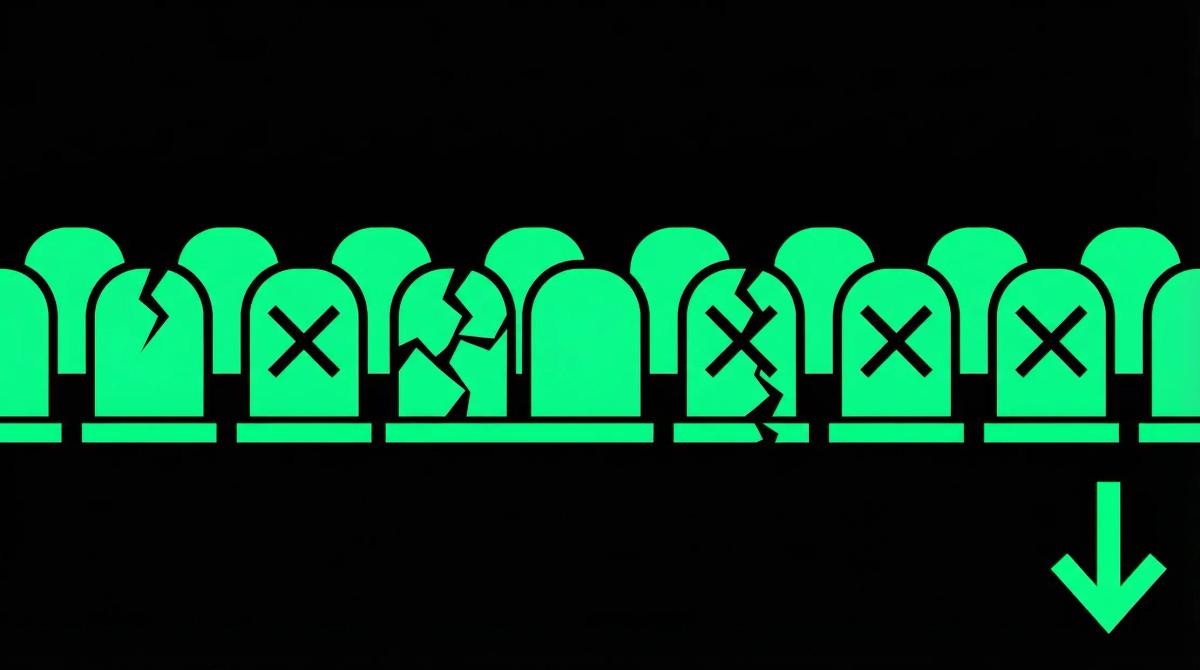

The Graveyard: The Tier-2 Collapse

The "Middle Class" of exchanges died in 2025. Names that were familiar in 2023/2024—mid-tier exchanges that relied on altcoin gems and loose KYC—faced an extinction event.

Why did they die?

- CAC (Customer Acquisition Cost) Explosion: With Google and Meta tightening ad restrictions to only "Licensed Entities" in 2025, Tier-2 exchanges lost their marketing funnels.

- The "Vampire Attack" of Compliance: Users realized that keeping funds on an unregulated exchange was a risk to their future ability to off-ramp. Banks started auto-blocking transfers from non-Tier-1 exchanges in mid-2025. This caused a bank run on Tier-2 platforms, not due to insolvency, but due to banking isolation.

The Risk: The "Honeypot" & Regulatory Capture

The victory of the "Big Three" comes with a dark side.

- The Surveillance State: To maintain their licenses, these exchanges now share unprecedented amounts of data with tax authorities and intelligence agencies. The "privacy" aspect of CEX trading is nonexistent in 2025.

- Centralization of Custody: With 88% of volume in three silos, a single technical failure or hack at Binance or OKX would be a systemic catastrophic event for the entire industry. We have put all our eggs in three baskets.